The Business Responsibility and Sustainability Reporting (BRSR) mandate, introduced by SEBI, is no longer something Indian companies can keep on the backburner. From FY 2025–26, the top 150 listed companies by market capitalization must submit BRSR Core reports — detailed, third-party verified, and covering not just their own operations but also their value chain.

This shift signals a new era where ESG reporting in India moves from a voluntary good practice to a mandatory sustainability disclosure requirement under SEBI.

What is BRSR and BRSR core?

BRSR (Business Responsibility and Sustainability Reporting):

Launched in 2023, BRSR replaced the older 2009 BRR (Business Responsibility Reporting) guidelines. It brings Indian disclosures closer to international ESG frameworks such as the GRI (Global Reporting Initiative) and TCFD (Task Force on Climate-related Financial Disclosures).

Companies must now answer 140 disclosure questions:

- 98 mandatory indicators

- 42 voluntary “leadership” indicators

These disclosures are structured around the nine principles of the NGRBC (National Guidelines on Responsible Business Conduct):

- Environmental protection – Electricity use, water consumption, emissions

- Human rights – Violations, fair wages, safe working conditions

- Integrity – Anti-corruption, anti-bribery, conflict-of-interest policies

- Employee well-being – Benefits, accessibility, unionization metrics

- Inclusive growth – Focus on vulnerable/marginalized groups

- Sustainable goods & services – Investments in eco-friendly and socially responsible products

- Responsible consumer engagement – Complaints, recalls, data privacy, cybersecurity policies

- Stakeholder responsiveness – Engagement with marginalized groups

- Public policy engagement – Trade affiliations, anti-competitive conduct disclosures

BRSR Core:

This is a sharper, standardized subset of ESG KPIs. Unlike the full BRSR, Core disclosures must:

- Be third-party verified

- Cover the value chain (at least 75% of purchases and sales)

- Be comparable and auditable across industries

In essence, BRSR Core ensures ESG data is not just reported, but also credible, consistent, and investor-friendly.

Who needs to comply with BRSR?

The rollout of BRSR is phased:

FY 2022–23 onwards: Top 1000 listed companies (by market capitalization) had to submit BRSR as part of their annual reports.

From FY 2025–26: The top 150 listed companies must submit BRSR Core, verified and value-chain inclusive.

Future Expansion: SEBI has signaled that eventually all large listed entities will come under the BRSR Core mandate.

This means even mid-cap and smaller listed companies need to start preparing now if they don’t want to fall behind.

Why 2025 is a Game-Changer for Indian Businesses

This isn’t just about ticking off a SEBI compliance box — it’s about securing your position in an evolving market.

- Regulatory alignment: Meet SEBI’s ESG disclosure standards and avoid penalties.

- Investor attraction: Transparent ESG data improves ESG ratings in India and draws both domestic and foreign capital. For example, global funds often screen companies on ESG compliance before investing.

- Tender eligibility: Large government and corporate tenders (in sectors like energy, infrastructure, and manufacturing) increasingly require proof of ESG performance. Non-compliant companies risk losing lucrative contracts.

- Global competitiveness: Indian firms that align with international frameworks like the EU’s CSRD will have a smoother path exporting to markets that demand ESG disclosure.

In short, 2025 marks the shift from optional to essential — those who lag may face capital, market, and reputational disadvantages.

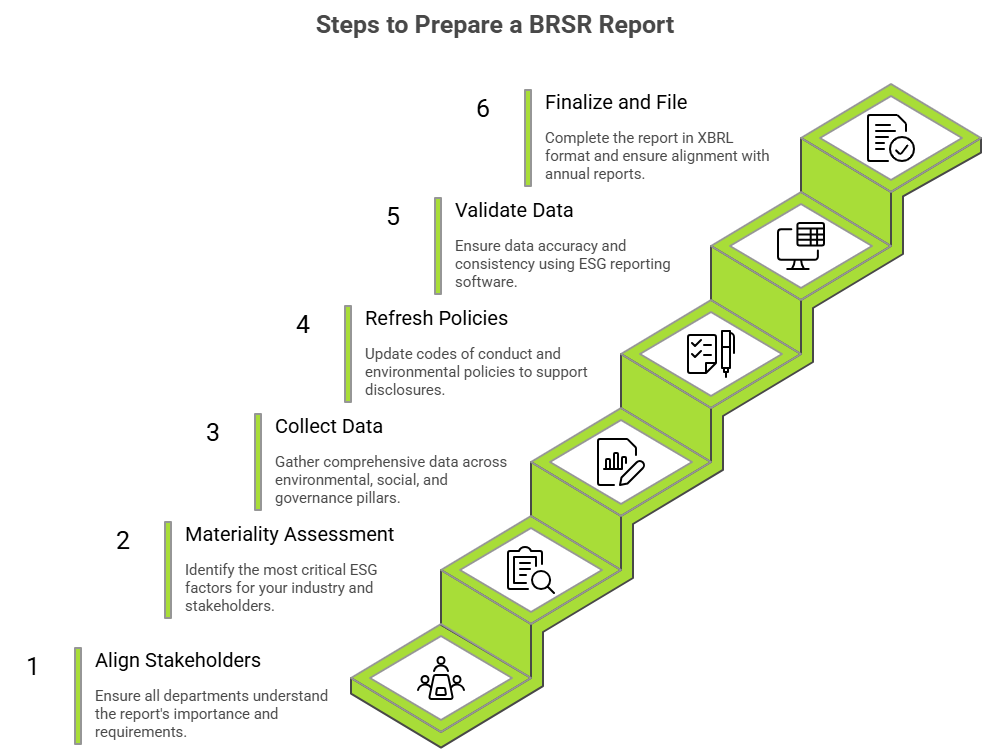

Step-by-Step Guide to Preparing a BRSR Report

For many businesses, drafting a Business Responsibility and Sustainability Report can feel like a heavy lift. But when broken into structured steps, the process becomes far more practical and less intimidating.

1. Get Everyone on Board

BRSR compliance isn’t just the job of a sustainability team. Finance, HR, procurement, compliance, and leadership all play a role. The first step is aligning these stakeholders so everyone understands what’s required and why it matters.

2. Identify What Really Matters (Materiality Assessment)

Not all ESG issues carry the same weight for every company. A materiality assessment helps determine which environmental, social, and governance factors are most critical for your industry, stakeholders, and growth.

3. Collect the Right Information

Gather data across the three ESG pillars:

- Environmental: Carbon emissions, water usage, energy consumption

- Social: Workforce diversity, human rights, employee well-being

- Governance: Anti-corruption, board diversity, compliance policies

Organize these against the nine BRSR principles to ensure full coverage.

4. Refresh Policies and Documentation

Update your codes of conduct, anti-bribery policies, grievance mechanisms, and environmental policies. These serve as proof points for your disclosures.

5. Check and Validate Data Quality

Accuracy is everything. Incomplete or inconsistent data can damage credibility with regulators and investors alike. Many companies now use ESG reporting software (e.g., SAMESG) to centralize metrics and reduce manual work.

6. Finalize and File Your Report

SEBI requires reports in a structured XBRL format. Cross-check for completeness, ensure alignment with your annual report, and confirm consistency across all disclosures.

The Challenges Companies Commonly Face

While BRSR compliance creates long-term value, organizations often struggle with:

- Scattered data sources – Data spread across departments makes collection slow and error-prone.

- Limited ESG expertise – Many firms lack in-house sustainability specialists.

- Unclear guidelines – Some disclosures leave companies unsure of the required depth.

These hurdles can make compliance feel overwhelming — but with the right preparation, tools, and training, they can be turned into opportunities.

The Takeaway

The BRSR mandate in India is more than just another compliance rule — it’s a business transformation opportunity. Companies that prepare early will:

- Ensure smooth SEBI BRSR compliance

- Strengthen their ESG ratings in India

- Build investor and stakeholder trust

- Gain a competitive edge in tenders and global markets

The clock is ticking. By 2025, ESG disclosure will be as routine as financial reporting. The question Indian businesses must ask is not whether they can afford to comply, but whether they can afford not to.

Our Latest reads

- COP30: The Final Days That Captured the Reality of Climate Talks

- Digital Product Passport for Textiles: From Preparation in 2026 to Compliance in 2027

- ESPR vs. Green Claims Directive: How the Digital Product Passport Bridges both

- Beyond Compliance: 4 Circular Business Models the Digital Product Passport Makes Possible

- DPP Non-Compliance Risks: How Non-EU Exporters Could Lose EU Market Access